This is the bank's standard checking account for everyday banking. The $15 monthly maintenance fee is waived if you keep a minimum daily balance of $100. There's also no monthly maintenance fee for students aged 17 to 23. TD Bank offers student checking accounts for those between the ages of 17 and 23 who are full-time students. However, when you turn 24, the bank account will automatically transition to a Convenience Checking account, where you must abide by the minimum daily balance required or pay a monthly maintenance fee.

Therefore, as you get close to your 24th birthday, keep an eye on your balance and current guidelines for the standard TD checking account so that you don't get hit with unexpected account fees. This is a checking account with more perks and features than Convenience Checking, but you need to have a more significant banking relationship with TD Bank to make it worthwhile. Still, the fee can be waived if you make monthly direct deposits of $5,000 or more, keep a minimum daily balance of $2,500 in the account or have a combined balance of $25,000 across multiple TD Bank accounts. Qualifying customers with the TD Beyond Checking account also get free ATM transactions at non-TD Bank ATMs, two free overdraft fees per year and other perks like free standard checks. The Beyond Checking account also pays interest, but the APY is currently 0.01%.

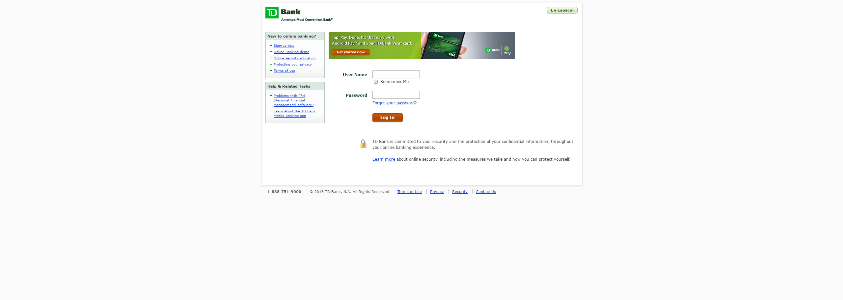

TD Bank Online banking services have made it easy for customers to bank any time provided they have enrolled for free services. Customers can also access their bank accounts online on their mobile web browsers or by downloading the mobile app of playstore and itunes. This guide will direct you on how to access your online account, how to reset the password in case you want to and enrolling for the internet banking services. Download our mobile app to get on-the-go access to your accounts and bank securely 24/7.

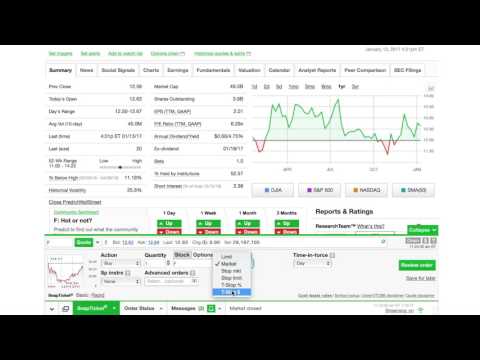

Anywhere you are, view your balance, deposit checks, send money, transfer funds, pay bills and more. However, the Beyond Checking account offers a wider range of benefits. Banking customers have a few ways to waive their monthly fees. They can meet the minimum daily balance, as explained, hit a monthly direct deposit minimum, or meet a minimum balance across all their eligible TD bank accounts.

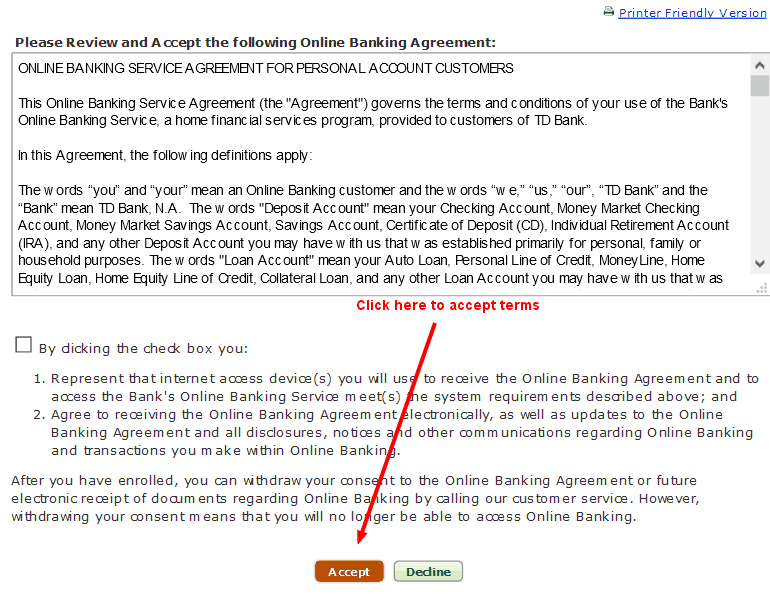

This account also offers no ATM fees and reimbursement on some wire transfers. Holders can even get reimbursed for overdraft fees two times per year. External transfer services are available for most personal checking, money market and savings accounts. To use these services you must have an Online Banking profile with a U.S. address, a unique U.S. phone number, an active unique e-mail address and a social security number. Your eligible personal deposit account must be active and enabled for ACH transactions and Online Banking transfers. TD Bank is a full-service bank that offers loans, credit cards and other financial products.

If you have a checking account with them, it may provide you with a better deal on a personal loan, a mortgage or other financial accounts. It places a strong emphasis on customer service and makes it easy to contact customer service via in-app communication, social media channels, as well as email or phone. There is a $5 monthly maintenance fee for this account, which the bank will waive if you maintain a $300 minimum daily balance or link your savings account to a qualifying TD Bank checking account. To use these services you must have an Online Banking profile with a U.S. address, a unique U.S. phone number, an active unique e-mail address, and a Social Security Number.

The tablet enables users to manage their personal bank accounts and check their balances and transactions for checking, saving and money market accounts. TD Bank has found that consumers prefer online banking on tablets due to the wider screen and easier ability to see figures and details. Customers who open a new TD Convenience Checking account and make at least $500 in direct deposits within the first 60 days will qualify for a $150 TD Bank checking account bonus. The Convenience Checking account is best for students, young adults or customers who can't meet the minimums required by TD's Beyond Checking account. There is no monthly maintenance fee for students, young adults or account holders who maintain a $100 minimum daily balance.

Account holders who don't meet these requirements are subject to a $15 monthly account maintenance fee. TD Bank is currently offering a couple of checking account promotions for customers who open new accounts. To qualify for the TD Bank sign up bonus, customers must open the new account and meet certain deposit requirements. Once customer eligibility and completion of the offer requirements have been verified, TD Bank will deposit the applicable cash bonus into your new bank account within 140 days.

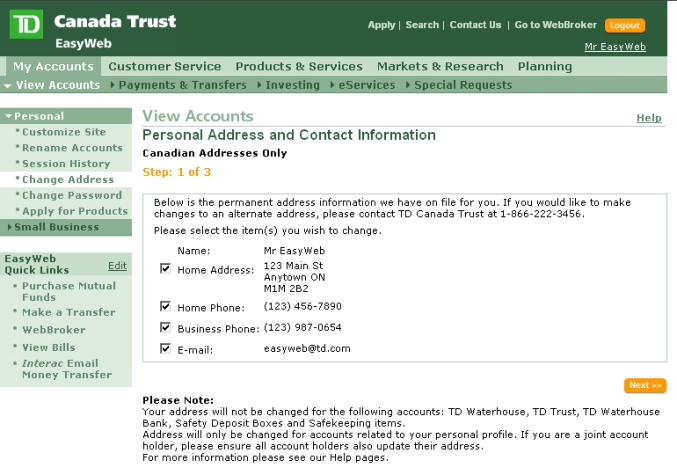

Another way to stop overdraft fees is by changing banks. Some banks offer checking accounts without monthly fees, overdraft fees or non-sufficient funds fees, including Discover Bank's checking accountand online bank Simple's checking account. Wells Fargo plans to roll out two types of checking accounts without overdraft fees early next year. The bank's internet banking portal is called EasyWeb and makes it easy for clients to manage their bank accounts around the clock from anywhere in the world as long as they are connected to the internet.

For those who want to bank even when they are on the go, there is a free app that they can download to their mobile devices. The EasyWeb portal and mobile apps offer online security guarantee and any unauthorized transactions are usually reimbursed by the bank. This option can work well for those who meet the monthly requirements to waive the monthly maintenance fee, for example, established professionals who are enrolled in direct deposit. However, students who may struggle to meet the requirements to waive the fee on the Beyond Checking account will find that Convenience Checking offers an excellent option.

The Convenience Checking account comes with a waived minimum balance, no monthly fees and free overdraft protection. With over 1,250 locations throughout the Northeast and Southeast regions of the U.S., TD Bank offers a robust brick-and-mortar presence and an array of checking and savings account options. However, compared with other banks — particularly online banks — TD Bank falls short in terms of offering competitive rates and minimizing fees. Additionally, you will need to have your bank account information ready, including your routing and account numbers. The next step is to select the type of account that you want to enroll for TD online banking. You can enroll your personal, small business account, or both your personal and small business accounts.

TD bank will then ask you to confirm that you are the owner of these accounts. In online banking, you will first need to add an account. From within any account, select the Transfer Money icon and choose Add An Account. Once the account is added and confirmed, it can be used for transfers. You can set up same day/future dated/recurring transfers in either online banking or the mobile app. Use secure online and mobile banking to deposit checks, pay bills, send money to friends and more.

Once you're unenrolled, your debit card purchase will be declined if there's not enough money in your account. TD Bank offers several checking account options, including a student checking account that will benefit many different customers. These accounts generally work best for those who can meet the requirements for waiving maintenance fees, either as a student or by maintaining a minimum daily deposit.

In a proven case of online fraud, you are protected by the 'Customer Services Rules', which ensure that your funds are returned to your bank account by your financial institution. 1Send Money with Zelle® is available for most personal checking and money market accounts. To use Send Money with Zelle® you must have an Online Banking profile with a U.S. address, a unique U.S. mobile phone number and an active unique e-mail address. Message and data rates may apply, check with your wireless carrier. As with many other bank cash back bonus offers, TD Bank's current promotions are only open to new customers.

TD Bank defines a new customer as customers who do not have a current checking, savings or money market account and who have not had one within the previous 12 months. To be eligible for any of these promotions, you must also open your account online through one of the designated offer links. If you have higher monthly direct deposits and a bit more liquid cash to spare, you can earn a higher bonus with TD's Beyond Checking account. Customers who open a new Beyond Checking account and make at least $2,500 in direct deposits within the first 60 days will qualify for a $300 cash bonus. The Beyond Checking account is best for customers with consistent direct deposits over $5,000 per month or who can maintain a daily balance of $2,500 or more.

Account holders who cannot meet the minimum daily balance or direct deposit requirements are subject to a $25 monthly account maintenance fee. TD Bank charges a $35 overdraft fee, up to five times per day. You can link your checking account to a TD savings account for overdraft protection, but there's a $3 fee each time you transfer money to cover an overdraft. But under current laws and regulations, banks have to give customers the option of opting into overdraft programs before charging them these fees. According to the consent order entered Thursday, TD Bank didn't do that.

In some instances, the CFPB claims TD Bank had new customers sign up for its Debit Card Advance overdraft program with the "enrolled" option pre-checked and did not mention the service at all. The convenience that the internet has brought has made gone are the days of needing all your financial services under one roof. You can bank from anywhere in the world provided you have internet connection. And smartphones have made this a lot easy since you can now bank even when you are on the go. TD Bank has embraced technology in its endeavors to provide customers with reliable and convenient banking services.

Customers only need to register on the bank's website to get started with internet banking. Online Banking customers can transfer funds between their personal TD Bank accounts as well as to or from their accounts outside TD Bank. If you're just looking for a standard checking account, TD Bank may be an easier option for affordable checking. If you can maintain a daily balance of at least $2,500, TD Bank will reimburse you for all ATM fees incurred. Another standout checking account is TD Bank's Convenience Checking account, as it requires a low minimum balance of $100 to waive its $15 monthly maintenance fee.

However, if you want the convenience and accessibility of banking at a larger regional bank with a footprint throughout the East Coast, TD Bank offers some valuable features and benefits. The mobile app is highly rated and well designed for everyday banking. It offers convenient features like compatibility with digital wallets, mobile check deposit and the ability to send money with Zelle. In a proven case of online fraud, you are protected by the 'Customer Services Rules', which ensure that your funds are returned to your bank account by your Financial Institution. These 'Rules' are based on the reputable Canadian Code of Practice for Consumer Protection in Electronic Commerce. While we work with all stakeholders, as well as security experts, to maintain the ongoing security of our services, there are actions that you can take as well.

You are encouraged to regularly check your bank statements to verify that all transactions have been properly documented. If entries do not accurately reflect transaction activities - for example, if there are missing or additional transactions you should immediately contact your financial institution. Axis Bank provides easy steps to start online banking. Avail a variety of benefits and services by Axis through the online banking service. Hassle-free internet banking options makes banking with Axis Bank the best.

Banks typically charge overdraft fees when you overdraw your checking account. Instead of having your debit card declined or the purchase canceled, your bank will cover the difference and charge you an overdraft fee. TD Bank, for example, charges $35 when you overdraft your account by more than $5 and levies up to five of these charges per day.

TD Online Accounting helps businesses increase and accelerate their cash flow by providing a self-service, digital onboarding experience to help business owners get paid electronically. As a payment facilitator, Autobooks enables a business to begin invoicing within moments of enrollment and to start processing payments shortly after. For ease of use, TD Online Accounting is available to current TD business customers with a business checking account who are enrolled in online banking. The bank offers a wide range of financial services to small business and personal clients. It is pretty easy to open a savings or checking account at TD Bank once you have decided on the type of account that you think will be suitable for you. Many banks require minimum balances so that they have enough funds on hand to support other banking activities, such as providing loans.

TD checking accounts can be easily connected to savings accounts. The savings accounts can also be used as a security deposit when applying for a credit card. The TD Cash Secured Credit Card offers 1% cash back.

Students can use this card to start building their credit history with a line of credit. Like many other major banks, TD Bank is currently operating in a near-zero interest rate environment that makes it hard to offer very compelling APYs on savings accounts, money market accounts and CDs. If you want higher APYs on your savings, you may want to consider an online bank or credit union. TD Bank's student checking account offers special perks for students and young adults ages 17 to 23, such as no monthly fee and no minimum deposit. And there's a monthly fee of $5, which is waived if you can maintain a $300 minimum daily balance. For the first 12 months only, you can avoid the fee by transferring $25 monthly from a TD checking to savings account.

For customers with larger balances, TD Beyond Savings can earn higher rates, but if your balance falls below $20,000, the monthly fee is $15. But before all that, you will have to register for its online banking which is what this article will teach you. All you have to do is to follow the basics and you are good to go. Send, receive and request money by email or text using Send Money. Pay bills with convenience and simplicity to almost any person or company in the U.S. Transfer funds between your TD Bank accounts or with an external account.

Single-use security codes instead of security questions. Unique security codes make banking with us more secure. Our Mobile Banking App offers convenience on the go while you are out and about. You can check your account balances, view and perform transactions, and view your check images. Our funds transfer feature allows you to move funds immediately between your accounts or schedule future transfers.

Our bill pay feature is easy to use and you can pay almost any company or person. Online Banking gives you real-time account information. You can view check images, stop payments on checks, track your debit purchases and set up other tools to manage your money including e-mail balance alerts and online statements. For personal accounts, you will need to provide your Social Security number, email address and phone number to enroll in Online Banking. You will also be asked to verify your enrollment using either your ATM/CheckCard Number and PIN, or a Customer Number .

TD Bank requires a social security number to sign up for online banking. However, you can still register for online banking even if you do not have a social security number, if the bank can bank confirm that you are the owner of the account. Additionally, you will need your TD Bank ATM, Visa debit and Visa credit cards. Have the email address that you used to open your TD Bank account as well. Why can I no longer download my credit card transactions into my software?

To download credit card transactions, sign on to KeyBank online banking and select Download Transactions. You will be able to download credit card transactions into your Quicken software. QuickBooks download for credit card information is not available at this time. Can I edit or delete a pending payment or transfer in online banking? In online banking, upcoming activity is displayed in the account details page of each account.

Scheduled payments can also be canceled from the mobile app by selecting the + button and Activity icon. Select the payment you wish to cancel in the Bill Payments menu. Fill the necessary details and configure your Internet Banking login password and transaction password. Now login and configure security questions and answers along with Passphrase. These two steps are mandatory for successful activation of your internet banking user ID.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.